EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

Attractiveness surveys

EY Attractiveness surveys are widely recognized as a key source of insight into foreign direct investment (FDI).

EY Europe Attractiveness Survey

To thrive in a period of geopolitical, environmental and technological transformation, Europe needs to adapt to investors’ new requirements. Find out more.

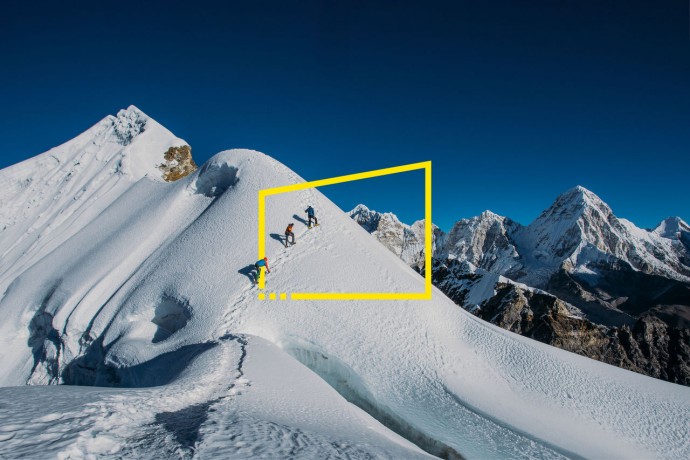

How can Europe turn on the taps of foreign investment?

The post-COVID-19 recovery of foreign investment in Europe stalled following fresh shocks in 2022 — but flows could be set to increase in 2023. Find out more.

About the EY Attractiveness program

By examining the attractiveness of a particular region or country as an investment destination, the EY Attractiveness surveys are designed to help businesses make investment decisions and governments remove barriers to growth.

A two-step methodology analyzes both the reality and perception of FDI in the country or region. Findings are based on the views of representative panels of international and local opinion leaders and decision-makers.

The program has a 21-year legacy and has produced in-depth studies for Europe, a large number of European countries, Africa, the Mediterranean region, India, Japan, South America, Turkey and Kazakhstan.

Additional geographic perspectives

One of the key drivers of growth is a country or region’s ability to attract investment. EY’s unique collection of country and region reports provide companies and governments with reliable insight to shape economically sound strategy and policy decisions to drive growth and investment.

Find out how countries and regions are benchmarking their investment attractiveness in the following reports:

Our latest thinking

How can boards convert sustainability from a wish to a winning reality?

Boards must lead a decisive sustainability agenda or face a constrained future, finds the EY Europe Long-Term Value and Corporate Governance Survey. Read more.

How can boards strengthen governance to accelerate their ESG journeys?

With an increasing focus on sustainability, European boards must address ESG factors to unlock new sources of value creation. Find out how.

How European cities can unlock recovery and growth post-COVID

Europe’s major cities have new rivals for foreign investment, as new opportunities unlock growth potential for smaller cities.

Will there be a ‘next’ if corporate governance is focused on the ‘now’?

A new survey of European business leaders shows renewed corporate governance as key to long-term value over short-term pressures.

How is uncertainty reframing the future of investment in Europe?

Following EY's 2020 Europe Attractiveness survey, executives were gauged in October on their sentiment on Europe's post-COVID-19 prospects.

How foreign investment in Europe, by Europe, can drive economic recovery

To remain attractive, Europe must put collaboration at its heart and simultaneously embrace digital, innovation and sustainability.

Our team

Julie Teigland

Passionate about the transformational power of digitalization and innovation and its potential to deliver sustainable, inclusive growth for clients. Prominent voice of the Women20 global agenda.

Hanne Jesca Bax

Experienced leader blending different cultures, generations, mindsets and genders.

Marc Lhermitte

Fascinated by the complex interactions between companies, people and the geographies they live in.

Direct to your inbox

Stay up to date with our Editor's picks newsletter.